A Tough Year For Investors Comes To An End, The Fastest Growing Brands In 2022 Across Each Generation, & Business Sentiment Is Better Than Expected In The Midwest | (12.30.22)

“How wonderful it is that nobody need wait a single moment before starting to improve the world.” ―Anne Frank

What You Need To Know Today:

• Today is the last official trading day (half-day) of the 2022 calendar year. The bond market will close today at 2:00 PM ET / 1:00 PM CT. Let’s take a look at how various asset classes performed in 2022 (it wasn’t pretty):1

TL;DR — 2022 was a rough year for investors, especially those that didn’t take gains in 2020/2021.

• The Institute of Supply Management - Chicago, Inc (ISM Chicago) published the latest reading of the Chicago Purchasing Managers Index this morning which came in at 44.9, much higher than the pre-release market expectation of 40.1 and last month’s reading of 37.2.2 This index is also commonly known as the “Chicago Business Barometer” given that it is derived via a survey of approximately 200 purchasing managers in Chicago — asking them to rate the current relative level of business conditions. These conditions include topics such as employment levels, production, product/service prices, inventories, number of new orders, etc. Since businesses generally react very quickly to changing market conditions and purchasing managers hold some of the most current/relevant insight into a company’s view of the market, this index (and others like it) are considered among the best indicators for U.S. economic health. Since today’s reading is below 50 it does indicate contraction (rather than business expansion), however, it is a significantly “lesser” contraction than the market anticipated heading into the survey.

TL;DR — The “Chicago Business Barometer” came in “negative” from the perspective of those hoping for business growth (a reading above 50), but “positive” from the perspective of market participants who anticipated the reading (44.9) to be much lower.

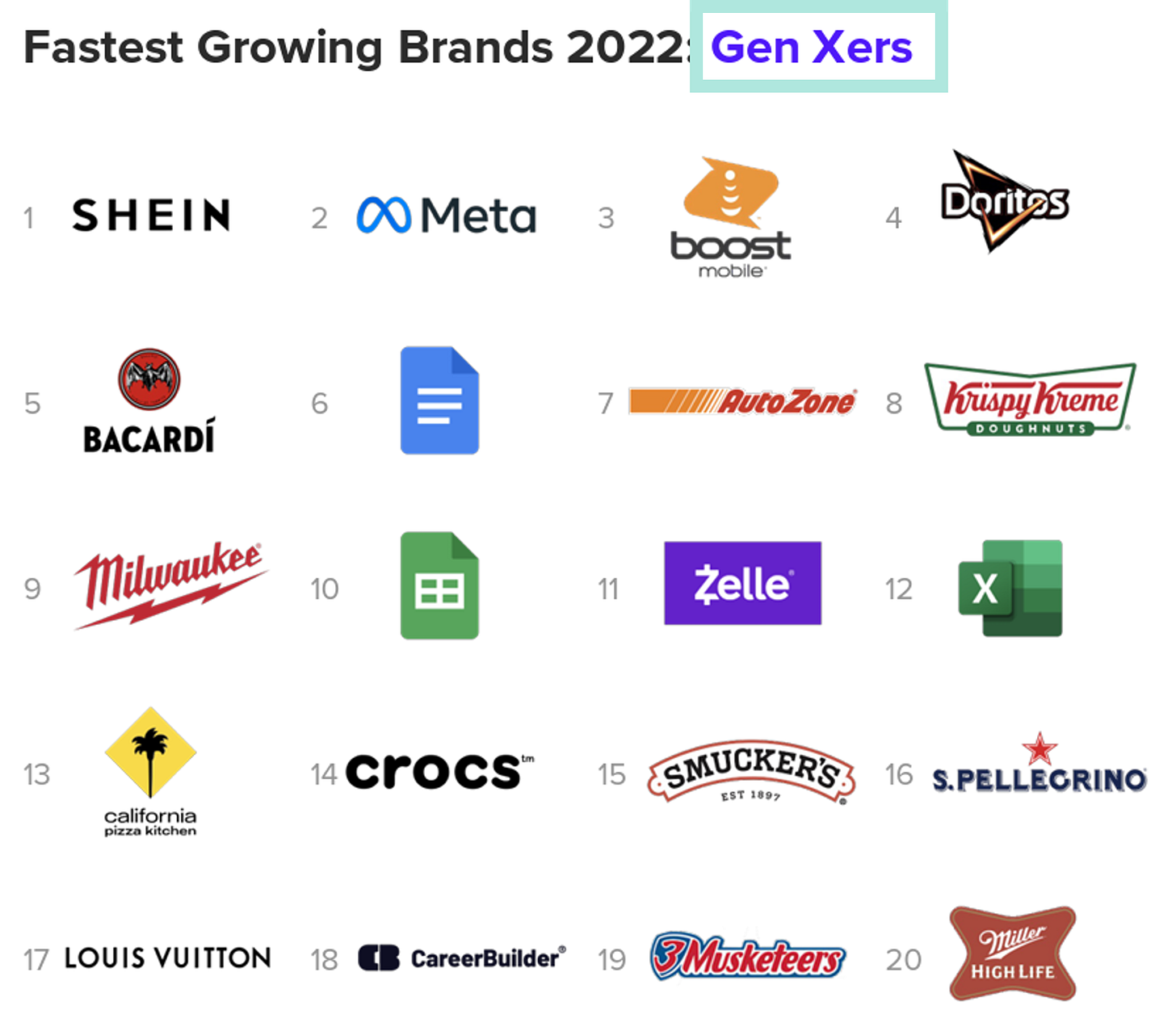

Chart Of The Day:

The below is a breakdown of the fastest growing brand across generations based on research by Morning Consult. Here is a link to the full presentation — I recommend you give it a read over the weekend, it is very interesting!3

Source: BlackRock Investment Research — Asset Return Map. Notes: The table shows annual index total returns (income or dividends reinvested) in U.S. dollars, indices are unmanaged and therefore not subject to fees. 2022 shows year to 30 November 2022. Indexes or prices used are: U.S. equities - MSCI USA Index, EM equities - MSCI Emerging Markets Index, Europe equities - MSCI Europe Index, Japan equities - MSCI Japan Index, China equities - MSCI China Index, DM gov. debt - Bloomberg Barclays Global Treasury Index, Emerging debt - JP Morgan Emerging Market Bond Index (EMBI) Global Composite, High yield - Bloomberg Barclays Global High Yield Index, IG credit - Barclays Global Corporate Credit Index, Commodities - Commodity Research Bureau (CRB) Index, Cash - Bloomberg Barclays U.S. Treasury Bill Index, REITs - S&P Global Real Estate Investment Trust (REIT) Index, Infrastructure - S&P Global Infrastructure Index.

Source: The Institute of Supply Management - Chicago, Inc (ISM Chicago) — Chicago PMI Index.

Source: Morning Consult — Fastest Growing Brands 2022.