If You Don’t Read This, Your Competitors Will (Homepage #48 🏠)

“You can’t build a reputation on what you are going to do.” – Henry Ford

Let’s Arm You For When Clients Ask How The Market/Economy Is Doing:

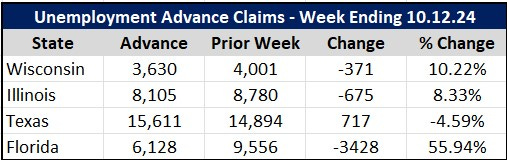

We received updated unemployment claims data this morning measuring the number of individuals who filed for unemployment insurance for the first time within the past week. Although a lagging indicator, it can give us a peek into the coming weeks/months' economic conditions. Heading into the report, the market hit the nail on the head by anticipating the 241,000 new claims that came to fruition across the United States.1 This figure is down 19,000 from the 260,000 claims in the last reading. Below, I have lifted the stats for the states where most readers of The Homepage reside (currently, anyway) so that you can more easily discuss these figures as they relate more specifically to your local market. Of these states, only Texas saw an increase in unemployment claims. On the flip side, Florida saw a drastic reduction in claims — almost certainly a byproduct of the recent natural disasters.

TL;DR — Nationally, there were fewer unemployment claims this week — in line with market projections.

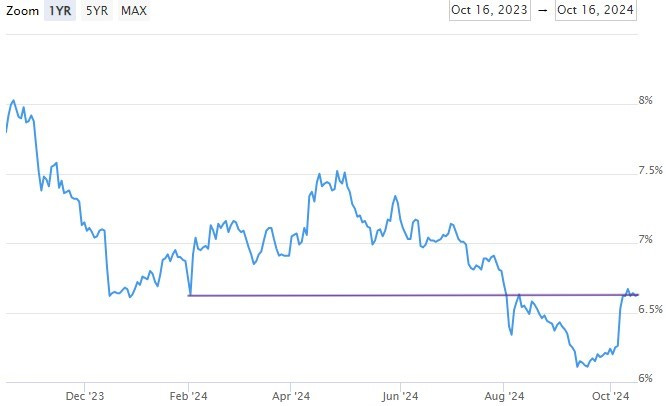

Mortgage rates have returned to levels last seen in February 2024, potentially signaling a further delay in the impending “refinance boom” that seems to be the continued market consensus. That said, it does seem as though the sharp move upwards from ~6.11% to ~6.63% over the past month has been met with a considerable shift in market sentiment.2 You likely have seen far fewer loan officers / real estate professionals posting rates on their social media accounts, as the way up is not nearly as exciting. To be frank, and especially given the upcoming presidential election, from a market insider's perspective, it feels as though there is more uncertainty now than at any other point since approximately the beginning of 2022. This statement is anecdotal, of course, but I am a massive nerd and spent a lot of time doing this so take it for what it’s worth. The market is essentially holding its breath.

TL;DR — Our “refinance boom” and “lower rates bring more buyers to market” dreams hit a speed bump.

This week, I read a few crazy statistics published by the National Association of Realtors (NAR). According to them, 71% of buyers interview only one real estate during their home search.3 ONE! Even more significant, 81% of sellers in 2023 contacted one agent (ONE) before deciding who to work with to list their home. Lastly, of sellers, 46% used the same agent for their listing that they had used for the initial purchase. Think about how wild that is; if you can get in front of a prospect first, you are highly likely to land them as a client on the buy-side, and then it is essentially a coin flip as to whether or not they will work with you on their future listing (that in itself not a bad set of odds) but improved drastically if you had been their buyer agent AND made contact with them first on the prospective home sale. These numbers highlight that if you feel like your volume is lower than you wish it was, the most statistically significant thing you can do is simply have more conversations to better position yourself as the “first contact.” You might be reading this and thinking to yourself, “This is obvious,” but if you are completely honest with yourself, your daily sales practices are likely not reflective of a 70-80% significance on simply talking to somebody before anybody else does. Pick up the phone, my friends!

*These very much not totally AI generated people could be you! (likely with fewer fingers) *

TL;DR — The importance of getting to a prospective client FIRST cannot be overstated.

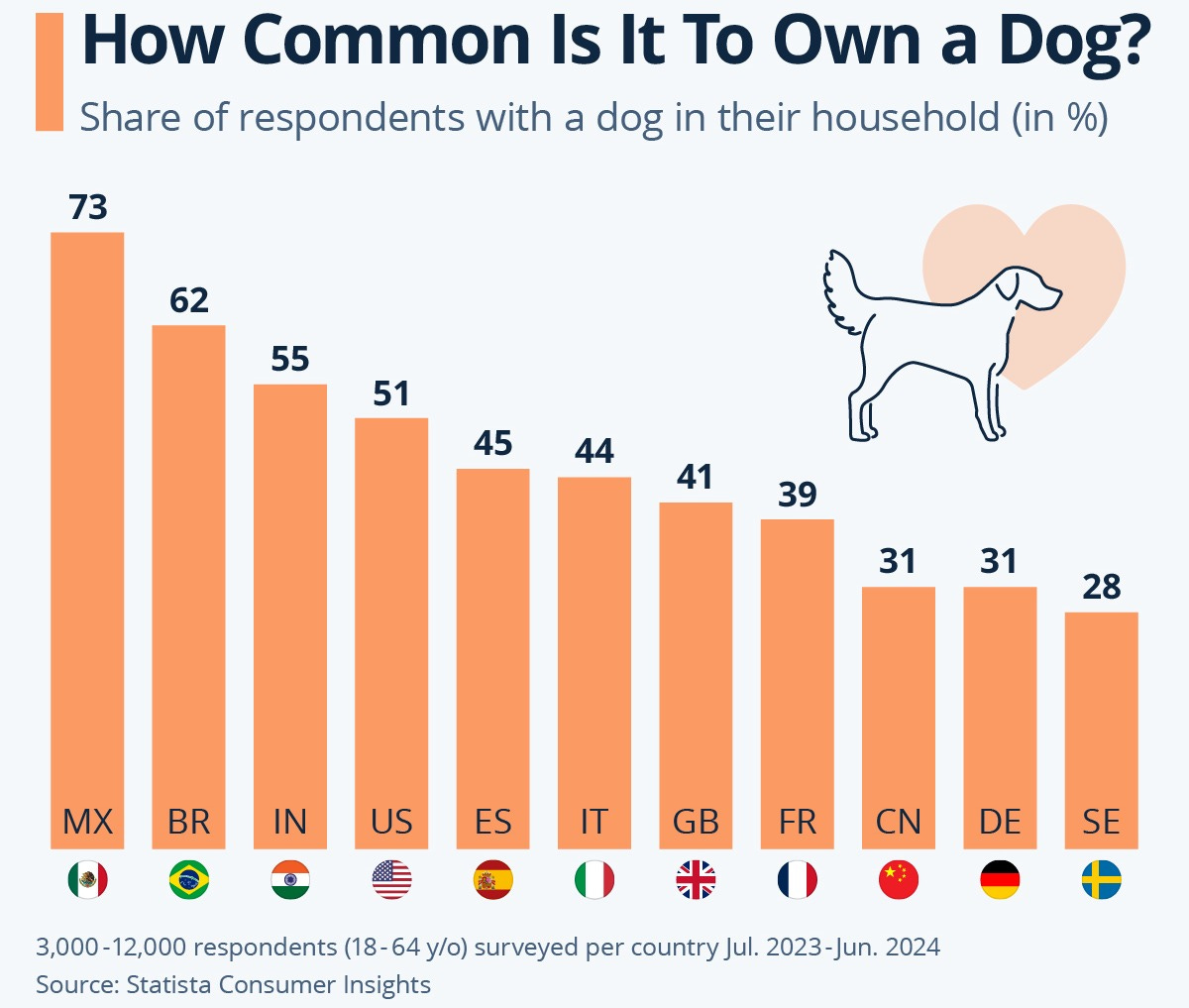

Graphic of The Day:

Did you know that in America, any given household is more likely to have a dog than not have one?4 Would you have assumed that this was the case? Don’t get me wrong, I am glad to see it and definitely think we should be looking to juice those numbers above and beyond Mexico, currently sitting up there at #1, but seriously, it would not have been my assumption that most households had one especially taking into consideration areas with high levels of population density. Also, keep in mind that this does not account for those with multiple dogs — it is just counting whether a household has one or not on a binary scale.

*Bonus picture of my pup below; please feel free to send me pictures of yours.*

TL;DR — It turns out most U.S. households have a dog(s).

Thank you for reading another issue of The Homepage!

Is there a specific type of content you’d love to see covered by The Homepage? Let us know. We are always open to suggestions as to how we can make this newsletter the best possible source of real estate/economic information each week.

Source: Mortgage News Daily.

Source: Statista Consumer Insights.