Let’s Cut Through The Noise — Here Is What You Need To Know Today. (Homepage #47 🏠)

“Who controls the past controls the future. Who controls the present controls the past.”- George Orwell, 1984

Here’s What You Need To Know:

Today’s consumer price index (inflation) data came in higher than expected at 2.4% year-over-year (all items) and 3.3% (less food and energy).1 Simultaneously, the latest unemployment reading also came in higher than anticipated, with 258,000 people filing this week --- above the expected 230,000.2 The Fed could now be facing somewhat of a nightmare scenario: an economic environment with both rising inflation AND increasing unemployment. On the one hand, if they continue to cut rates, they run the risk of another massive runup of inflation. On the other hand, if unemployment continues to rise, the economy could fall into a proper recession. The doomsday scenario would be a continued period of both at the same time or “Stagflation.”

TL;DR — The prospect of proper stagflation is terrifying for the economy.

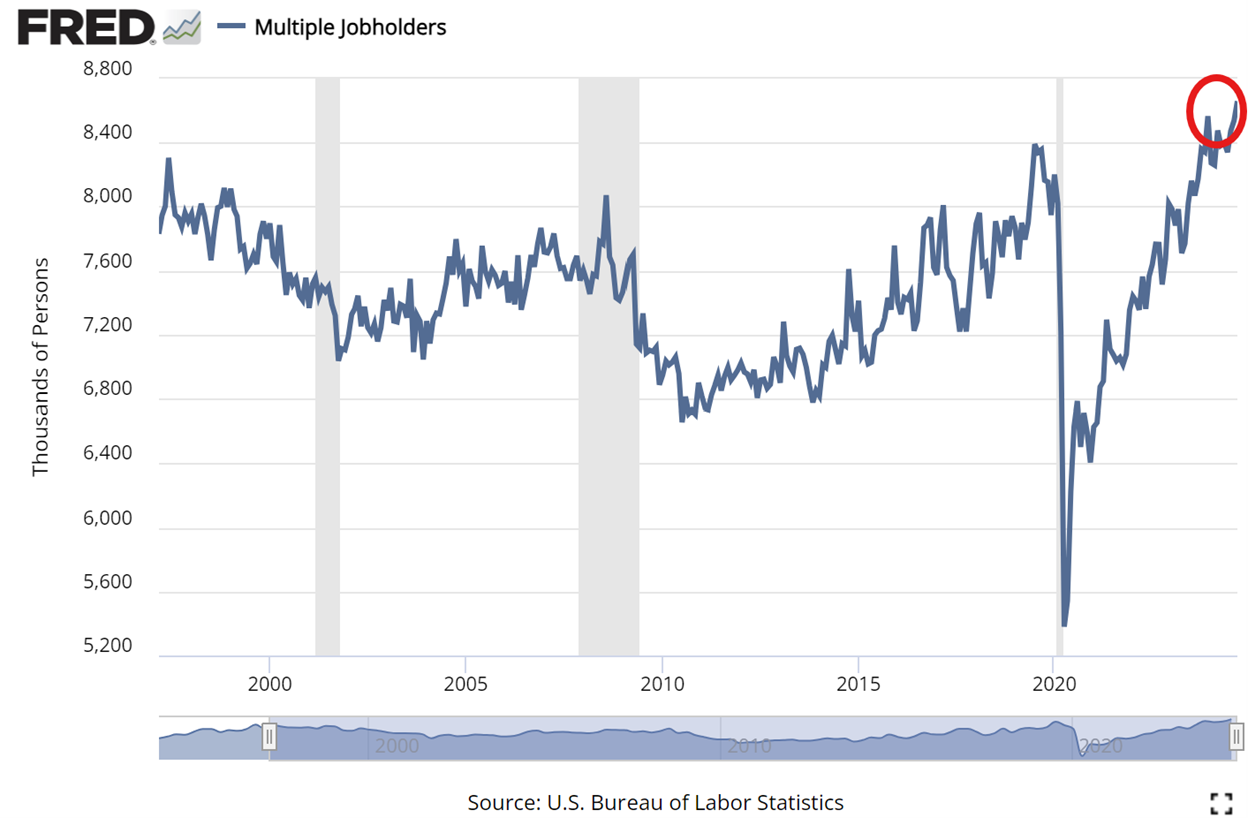

According to the U.S. Bureau of Labor Statistics, the number of Americans working multiple jobs has hit an all-time high of 8.66 million.3 For reference, this is ~300,000 more people than the peak seen prior to the COVID-19 pandemic and ~600,000 above the 2008 peak during the Global Financial Crisis. Let’s keep in mind that these are not people working multiple jobs to “get ahead” but rather mostly just to survive — see above inflation.

TL;DR — The number of Americans with multiple jobs hits a new all-time high.

Mortgage interest rates have increased by approximately ~0.50% since the Fed rate cut last month.4 This signals that the bond market is essentially revolting against the Fed and not anticipating that further rate cuts are imminent. Ultimately, and as noted above in bullet point one, inflation is proving yet again to be stickier than you think it is. It is beginning to seem less and less likely that there are only clear skies ahead. Keep a close eye on the bond/treasury markets, and refer to your favorite mortgage professionals for advice. That said, remember that NO ONE knows exactly what is going to happen in the future, and anybody who claims they do is, at worst, lying to you and, at best, lying to themselves.

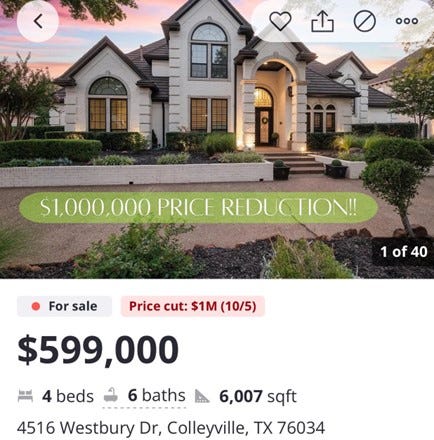

Listing of The Day:5

Well, this is one I certainly haven’t seen before — “Bold strategy, Cotton. Let’s see if it pays off for them.” In all seriousness, is this due to a horrible situation for the seller or a *potentially* genius marketing strategy by the agent? Perhaps other agents/their clients will see it knowing that they’ll have to write over, and it will create some sort of synthetic bidding war. Either way, I can’t imagine their neighbors are too happy about this one and any who were considering selling soon must be sweating looking at this.

TL;DR — Listing in the Dallas-Fort Worth area sees a $1,000,000 price “adjustment.”

Thank you for reading another issue of The Homepage!

Is there a specific type of content you’d love to see covered by The Homepage? Let us know. We are always open to suggestions as to how we can make this newsletter the best possible source of real estate/economic information each week.

Source: Mortgage News Daily.