The Market Anxiously Awaits The Fed Meeting Next Week. Also, Do You Own A Landline Telephone? | 12.7.22

“Honest criticism is hard to take, particularly from a relative, a friend, an acquaintance, or a stranger.” - Franklin P. Jones

What You Need To Know Today:

• The entire market is anxiously awaiting the final Fed meeting that will wrap up a week from today on Wednesday (12/14). There are MANY implications for the credit/money markets including what interest rates are likely to look like heading into 2023, as well as how strong the U.S. dollar will (or won’t) remain… In anticipation of this meeting the DXY Index, which tracks the relative strength of the U.S. Dollar compared to other major currencies, has traded down and broken beneath the 200-day moving average. The Fed meeting next week could be a significant catalyst for the DXY Index as it is sensitive to both interest rate movements and inflation levels. Higher levels of inflation indicate the need for more significant future rate hikes and, in turn, move the DXY up (stronger dollar). The opposite is true if inflation is “curbed” and we begin seeing interest rates move “flat” and eventually down.

TL;DR — The Fed meeting ending on 12/14 could be extremely significant for interest rates and the relative strength of the U.S. Dollar.

• The Energy Information Administration (EIA) released updated Crude Oil Inventories showing a week-over-week decline of -5.2 million barrels.1 This figure is lower than the pre-report market expectation of -3.5 million barrels and the previous reading of -12.6 million. This data matters because it is the primary gauge of supply/demand imbalances in the oil market, which can directly result in production level changes and price volatility. A lower supply of crude oil is likely to result in higher gas prices for consumers.

TL;DR — Crude oil inventories are lower than expected; Expect to see recently softened gas prices rise again.

• This afternoon (around 3:00PM CT) the Fed will release updated month-over-month consumer credit figures. These figures measure the change in the total cumulative value of outstanding consumer credit that requires installment payments — think car loans and loans on appliances/furniture. Further, understanding where cumulative consumer credit sits is important for determining the health of the economy as it is correlated with consumer spending and confidence. Generally, rising installment debt levels are a sign that lenders feel comfortable issuing loans and that consumers are confident in their ability to spend the money and then pay back the loan. Ultimately, however, the truth in that statement is mostly determined by the strength of the underwriting/risk management process before lenders issue loans. If they are too lackadaisical in their risk management rising installment debt could look much healthier on the surface than it actually is “under the hood.” The market expectation heading into today’s release is $28.2B, which would be up $3.2B from $25.0B in the last report.2

TL;DR — Updated consumer credit figures will be released this afternoon. The market expects a $3.2B increase in consumer installment debt since the last report.

Chart Of The Day:

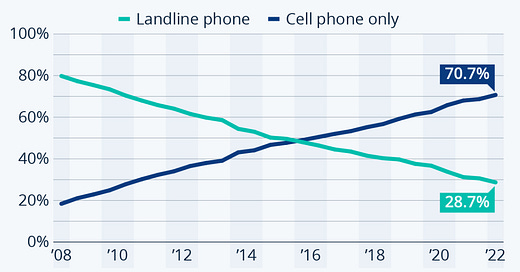

First of all, are you ever surprised when certain data comes from certain sources? For example, why is this measure of homes with (or without) landline telephones coming from the Centers of Disease Control and Prevention? Perhaps I don’t want to know the answer to that question and we will all find out in a handful of years when the CDC determines that us holding a machine producing RF waves directly to our face wasn’t the best idea… MOVING ON, and with that being said, I find it somewhat shocking that nearly 1/3 of all U.S. homes still have a landline. I would have guessed it was something like 10%. Do you personally have a landline or know somebody who does? If so, why hang on to it? Genuinely curious and responses are welcome. While the DVD player completely demolished the VCR and then streaming took out the DVD player, the landline telephone continues to put up a fight nearly ~40 years after the cellphone was invented.

% U.S. Adults Living In Households With/Without A Working Landline Telephone3

TL;DR — Nearly 1/3 of U.S. households still have a functioning landline telephone. Where the VCR and DVD player have fallen, the landline continues to fight the good fight.

Source: Federal Reserve.